The Fed continues to stick to its current theme of Inflation being of a "transitory" nature. Just like Inigo Montoya in the movie "The Princess Bride," who questioned Vizzini on his use of the word "inconceivable," I too am starting to question the use of the word "transitory" by the Fed. The market is awaiting some hint on the timing of Tapering, meanwhile, we believe the Fed is currently using all of its tools to keep inflation low, without the use of Tapering or raising interest rates. It appears, as of right now, that the Fed is using the old magician's trick - look at the right hand and don't pay attention to what the left hand is doing. Here's what we're seeing so far this week...

Inflation and the Fed. There is a debate among Fed Presidents and voting FOMC board members as to when should tapering begin. There are 6 presidents/FOMC members that are still in the "dovish" camp. Currently, five of the six have voting rights on the FOMC in 2021. In the "hawkish" camp, there are 10 members, but only four of them have voting rights in 2021.

This puts those in the "Taper soon" camp at a disadvantage. While several of these non-voting members - Kaplan (Dallas), Bullard (St. Louis), & George (Kansas City) - have been extremely vocal about beginning Tapering soon, they could be fighting an uphill battle in the short-term. This could mean that regardless of the movement in Inflation (more on that in a minute) and improvement in the Labor Market, the Doves could be in control for the time-being. This just means that instead of Tapering being announced next week and beginning in October, it's likely that Goldman Sachs is correct with their view that Tapering will be announced in November and begin in December.

Meanwhile, the Fed continues with it's theme of classifying the rise in Inflation as "transitory." This week's August print of CPI has dovish investors and financial pundits praising the slight decline in CPI month-over-month. However, we would caution against the prevailing thought that Inflation is on the decline. In October of last year and June of this year, we saw Inflation take a reprieve only to head higher in the following months. In addition, Producer Prices are on the rise and, based on the chart below, it would appear that not all of those costs have been passed onto Consumers as of yet.

Coming out of the pandemic last year, struggling with labor and shipping this year, and the possibility of higher corporate taxes, it's evident that Producers are willing to eat some of the inflationary costs in order to keep Consumers coming back for more. However, it's only a matter of time before Producers will reach a crossroads of costs & earnings, only to be forced to raise their prices.

Certain members of the current Administration are also in the camp that believes Inflation is "transitory." One member of the President's team recently said, "If you take out those three categories (beef, poultry, and pork), we've actually seen price increases that are more in-line with historical norms." (Brian Deese, White House Director of the National Economic Council) Yet, the chart below shows that other categories apart from beef, poultry, and pork have seen outside-the-norm price increases year-over-year.

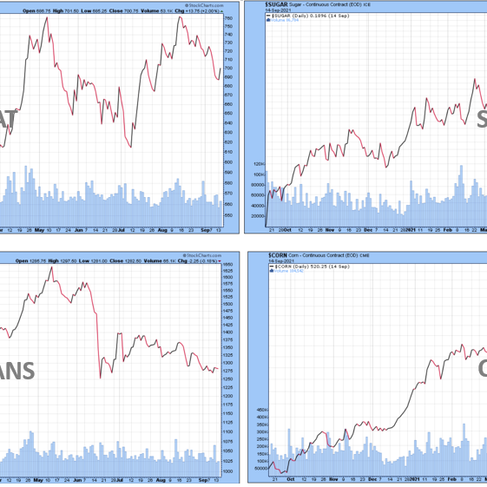

The table below summaries the one-year rise in the price of Oil, Coffee, Cotton, Wheat, Sugar, Soybeans, & Corn as of yesterday, September 15th. Looking at just those 7 commodities, the average increase in price is +76% over the last 12 months. The last time we saw such a move was from 2009 to 2012, when commodity prices increased following the 2008 Financial Crisis. To say that prices other than beef, poultry, and pork are rising in-line with historical norms is to either deny factual data or to blindly trust the pundits. This conundrum forced me to display below one of my favorite Inflation memes to put what the consumer is facing into some perspective.

What Is the Fed Doing About Inflation? This is where the magician's trick comes into play. The slight of hand is how magician's get the audience focused on what he or she is doing with the right hand, while secretly accomplishing the trick with the left hand. The Fed is controlling the overnight repo market in order to help tamp down on inflation. A couple of months ago we mentioned how the Fed was using the overnight lending market to influence how much banks were lending out - a function that would directly affect Inflation. The Federal Reserve uses an instrument called Overnight Repurchase Agreements, also known as "Repos," to provide lending to banks and financial institutions instead of leaving the money in interest-bearing accounts. Lately, the Fed has been using Reverse Overnight Repurchase Agreements (or, "Reverse Repos") in order to discourage banks and financial institutions from lending out what said institutions have borrowed from the Fed.

In this way, the Fed can offer these institutions higher returns in the overnight market, thereby reducing their incentive to loan out borrowed funds and accept the returns achieved through the reverse repo market. You can see that loans made to consumers has increased slightly by $80 billion over the last 18 months, while commercial loans have decreased by $680 billion (8.5x gains in consumer loans) over the same time frame. As long as the Fed continues to utilize the Reverse Repo market to help control Inflation, it could continue to wait on Tapering and Raising Interest Rates until it sees fit.

What Else Is Going On This Week? The S&P 500 Index came within 4 points of touching the 50-day moving average on Tuesday, as the benchmark had suffered losses in 6 of the last 7 trading days. And, like it has done all year, the benchmark bounced off the 50-day number and moved higher. If the Index stays above today's close of 4,480, it would be the 9th time this year that the benchmark has challenged the 50-day metric and bounced higher.

In other news, we'll find out tomorrow how the Labor Market is reacting to the end of extended pandemic-related unemployment benefits. The market expects Jobless Claims to inch higher by 20,000, after falling last week to a level of 310,000. Continued Claims are expected to remain about the same. The early returns show that Continued Claims, those on unemployment for at least one week or more, have dropped by 20% since the end of June. Those states that ended pandemic-related unemployment early in May & June saw better results than those states that left said benefits in place until last weekend. States that ended benefits early saw a decline of 32% since the end of June, while other states only saw a decline of 14% over that same time period. In fact, Continued Claims dropped this week by 187,000, so there are positive signs that the end of the pandemic benefits is moving people back into the workforce.

Getting people back to work and allowing consumers to spend freely without restriction is the fastest way to getting the economy at full strength and allowing for the Fed to end stimulus. Thursday, we'll get August Retail Sales, which will give us some insight into how consumers are reacting to COVID and Inflation. The market is expecting August's numbers to slightly improve over July's print. The Empire State Manufacturing Index, representing the New York region, showed vast improvement in August versus July. The Philly Fed Manufacturing Index also improved month-over-month. The NFIB Small Business Optimism Index also improved in August. The Chicago Fed's National Financial Conditions Index continued to show stability in the U.S. financial system. Until the Fed announces a decision, it's likely steady as she goes for most investors.

Comments