Equities move higher, but different sectors of the market are beginning to out-pace the Mag 7.

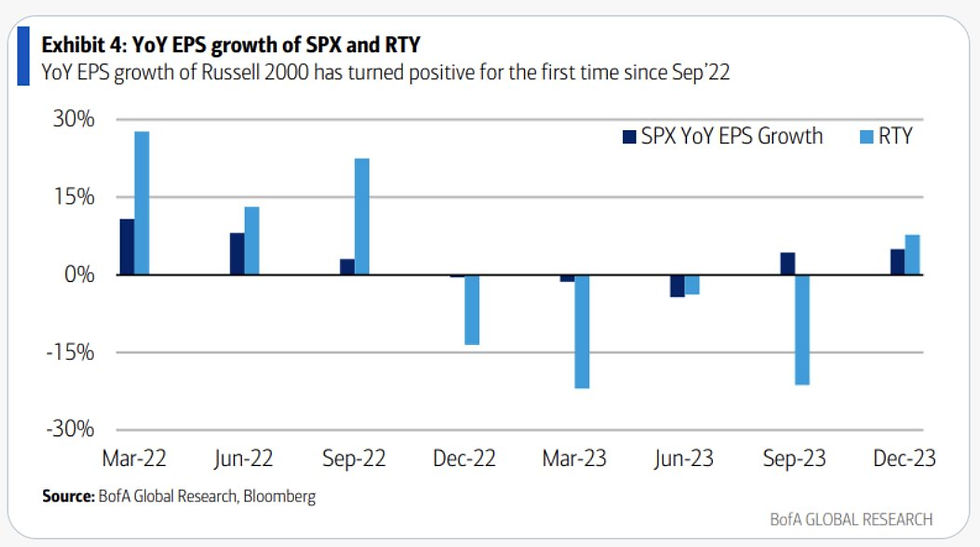

Last week we saw small cap stocks, which have been in a two-year slump relative to other equity asset classes, make new 52-week highs in what seems to be a breakout move. Mid-cap stocks also made new all-time highs. In addition, several equity sectors that have lagged Technology, such as Transports, Materials, and Retail, made new all-time highs. The point is that other sectors and asset classes are participating in the rally. The numbers, especially in small caps, seem justified as earnings growth just pulled out of a 4-quarter slump.

The spread between high yield credit bond and treasuries is very attractive and not near the levels seen just prior to previous bear markets.

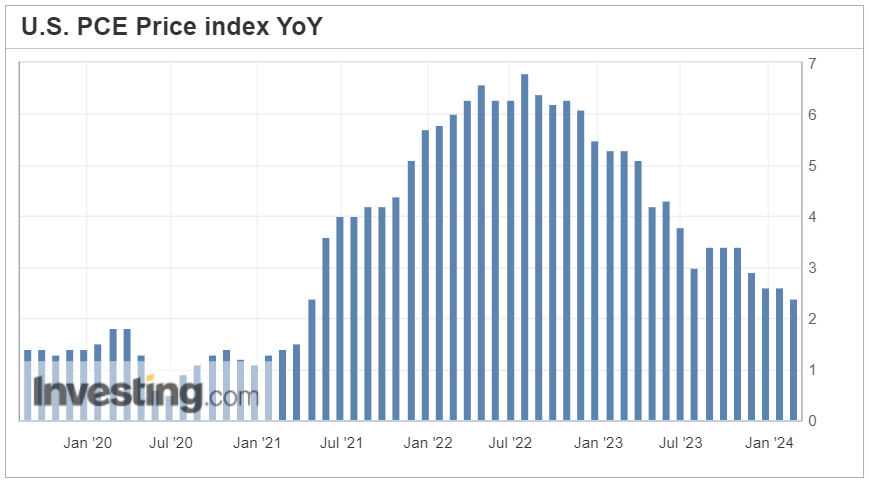

Meanwhile, the Fed’s preferred inflation metric, the PCE Price Index, was flat month-over-month last week and still lower year-over-year. We saw Personal Income exceed expectations last week and Personal Spending was flat, but still healthy. The S&P 500 Index is not exhibiting the type of growth that we have seen relative to prior bubbles. That doesn’t mean we’ve seen the last of volatility. The record streak of weekly wins will end at some point with a volatility increase.

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments